It is unfair for the people to be absorbing the costs of fuel price hike while TNB still making indecently huge profits.

On June 4, 2008, the government did it again by allowing TNB to raise power tariffs by up to 11 percent for households and 26 percents for commercial and industrial users. As like back in 2006, immediate after the news was announced, the share market response with a BUY call. Immediate after resuming trading on Friday(6 Jun 08) , TNB share price surged 85 sen to RM8.15, off the early high of RM8.70.

According to Chief Executive Che Khalib Mohamad Noh of TNB, TNB buys subsidized gas from national oil firm Petronas, but gas price will be raised 123 percent under the new price structure, part of a revamp of the government's subsidy scheme. He also pointed out that coal price has also gone up by more than 170 percent since 2006. Thus TNB has no choice but to revamp the power tariff.

President and Chief Executive Che Khalib Mohamad Noh said the new rates cannot fully cover TNB's operating costs due to increased prices of gas and coal it use to power its plants.

TNB expects a lower profit in the 2008 fiscal year. TNB expects a 4.8 billion ringgit (US$1.5 billion) increase in revenues from the tariff hike this year but its operating cost will rise even higher by 5.6 billion ringgit (US$1.75 billion; €1.13 billion), said Che Khalib Mohamad Noh.

Combined the profit of financial year 2007, RM 4.1 billion with the expected 4.8 billion ringgit revenues due to the tariff hike, after offset the RM5.6 billion hike in operating cost, TNB is expected to make at least RM3.3 billion for financial year 2008. No doubt a lower profit, but which is much high than what it earn in financial year 2006, RM2.16 billion, or previous years.

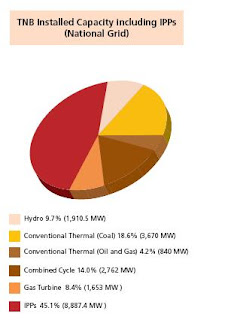

If we look at the above chart, power purchase from the IPPs make up 45.1 percent of TNB's total costs, oil and gas only 12.6% percent.

Even thought the price of crude oil has double from US$70 per barrel in 2006 to US$130 per barrel now. The cost of fuel can not be more than 28.1% of TNB's total cost (123 percent hike) . According to Goldman Sachs JBWere Pty., Asian coal price may rise 22% in 2008, this mean the cost of coal will increase to 22.7% of TNB's total cost . The power purchase from IPP is the real problem that punch a hole in its earnings, not the fuel hike.

| Financial Year | Profit |

| 2004 | RM813.7 million |

| 2005 | RM1.28 billion |

| 2006 | RM2.16 billion |

| 2007 | RM4.1 billion |

| 2008 | RM3.3 billion (forecast) |

If we look at the trend of TNB's profits for the last few year, you will realise that the government is all out to protect the interest of big corporation with total disregard to the interest of the people.

About 40 percent of Malaysia's total generation capacity of 19,000 megawatts is not used. TNB and the government should spend effort to attract investors to invest in Malaysia, as we have plenty of electricity, while China is facing big problem after Wenchuan earthquake.

The government again chose the easy way out by passing the cost and problem to the people, totally ignoring its responsibility towards the people.

TNB Power Tariff Hike

Egged on by investors, the government is allowing a tariff hike even though TNB and the IPPs are posting huge profits, says Ong Eu Soon.

When the public reacted with furore after the recent oil price hike, the government tried to assure the people that the oil price hike would not cause inflation.

The Prime Minister even pondered aloud, asking why there should be any price increases following the oil price hike: "I don't understand why prices of goods increase?" The government even pledged to go all out to curb inflationary pressures following the oil price hike.

Betting on the short memory of Malaysians, Energy, Water and Communications minister Dr Lim Keng Yaik announced on 24 May that the government will allow national power firm Tenaga Nasional Bhd to raise electricity tariffs from June 2006 - though small electricity consumers would not be affected..

Citing the spiralling cost of crude oil used to generate power as the reason for the tariff hike, Lim had earlier claimed that if the current tariffs were to be maintained, TNB would go bankrupt. The minister further noted that even with the new rates, the tariffs would still be among the lowest in the region.

Soaring profits

Is the tariff hike justified? It was reported that TNB's profit for 2005 was up 57 per cent, with the company earning RM1.28 billion, compared with RM813.7 million a year earlier. (Source: Reuters,

Judging from the persistent strengthening of the ringgit over the past six months, the ringgit is expected to further rise against the US dollar – in line with the overall weakening of the US dollar - over the next six months. With Bank Negara relaxing its grip on exchange management to tackle the inflationary impact from rising oil prices on the local economy, TNB stands to gain further from forex gains. A 1 per cent appreciation in the ringgit translates into a RM150 million gain for TNB. Of TNB's total debt of RM29.8 billion, RM13.7 billion or 46 per cent are foreign denominated debts (Source: StarBiz, May 6 2006).

The local currency has appreciated by around 5 per cent, which means TNB has gained a total of RM750 million. It is clear that the increase in the cost on fuel did not outweigh the forex gain. The issue of TNB going bankrupt if the present tariff rate is to be maintained is clearly unfounded, misleading and factually erroneous. In the words of

Lim Keng Yaik, the hike in fuel costs is just a mosquito bite for TNB.

Exorbitant IPP profits

If TNB is serious in boosting efficiency and productivity and in improving cost management, it should first target big power users with unpaid electricity bills, which run into more than a billion. It should reject outright the slipshod power purchase agreements with independent power producers (IPPs), which allow these IPPs to piggyback on TNB and rake in exorbitant profits to the detriment of TNB.

When news of a proposed tariff hike was first announced, research houses immediately reacted by upgrading TNB stock. Based on a forecast rate increase of 8 per cent for TNB, TA Securities upgraded TNB's 2006 earnings by 5.3 per cent and 19.8 per cent for 2007. The research house also raised its target price for the stock to RM10.50, based on 18.9 times the 2007 earnings per share of 55.6 sen for the financial year 2007. It maintains a 'buy" call on the stock.

According to CIMB Securities, every 1 per cent net increase in tariff rates would translate into an increase in earnings per share of 7-8 per cent (Source: Business Times, 6 May 2006). The buoyant mood among investors reveals to us how much TNB stands to gain from the tariff hike. This is a typical example of the indecent quest for profits and protectionism of big corporations with total disregard to the interest of the people.

Mismanagement

If the government is truly capable, it should promote the fact that our electricity tariffs are among the lowest in the region to foreign investors. It should tell investors who intend to invest or who have already invested in

competitive edge instead of constantly reminding Malaysians that we should pay more just because our tariffs are among the lowest.

passing on the cost of TNB's mismanagement and its erroneous policies to the

people. The decision to raise tariffs while TNB continues to chalk up sizeable profits is set to increase public discontent.

No comments:

Post a Comment